August 14, 2024

Texas Pour-over Wills Overview Massingill

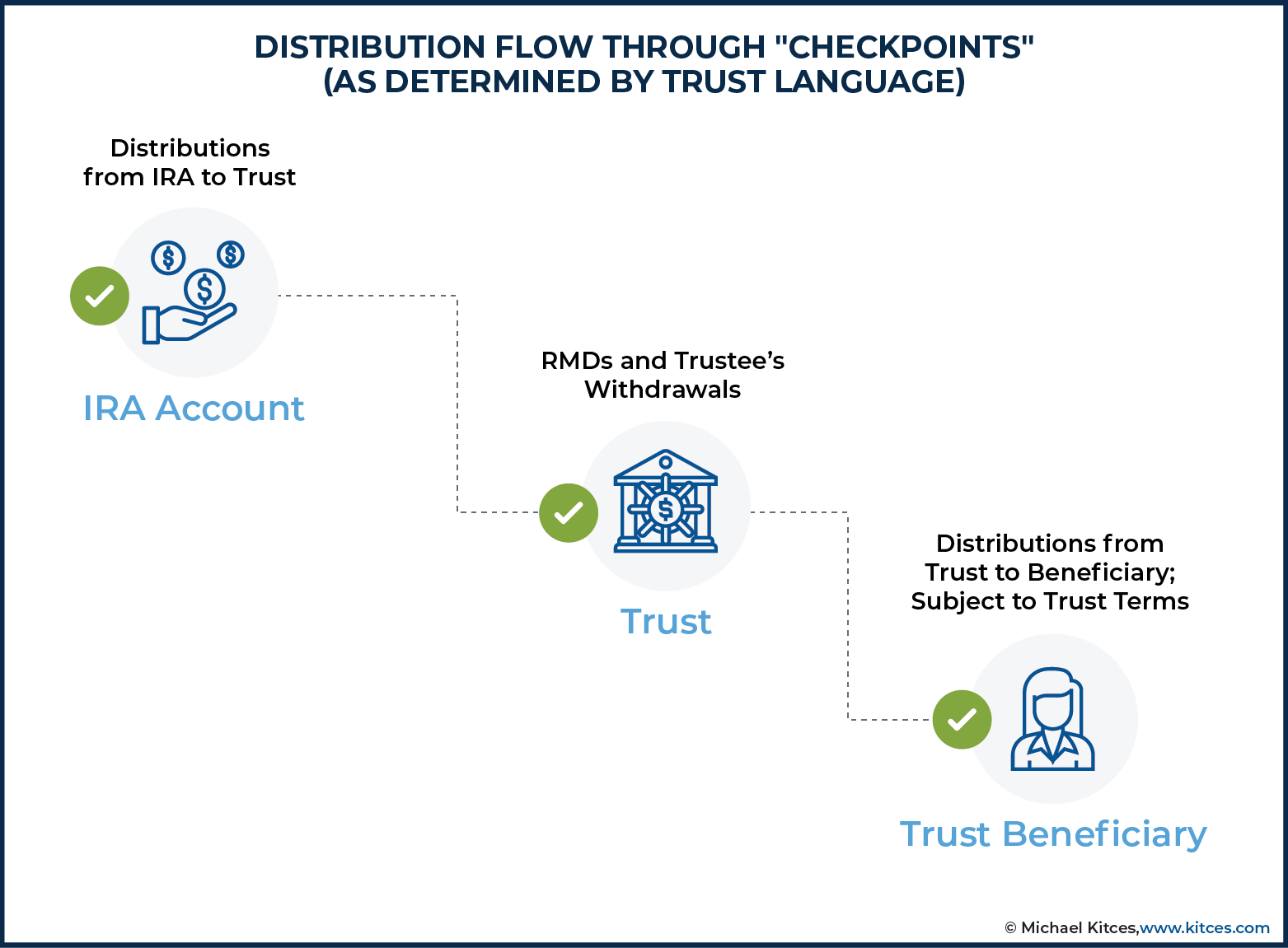

Pour-over Wills In California The Law Practice Of Kavesh Minor & Otis, Inc And the grantor may not have the ability to access their assets, also if a life occasion makes it Avoiding Probate essential. A criterion will is planned to account for the whole of the deceased's estate. Comparative, a pour-over will only offers guideline for managing possessions not included in the requirement will. It's finest not to utilize your pour-over will to fully money your depend on at the time of your fatality, since then all of your properties would need to go with probate prior to being positioned in the depend on. Instead, you must money your depend on as fully as possible during your life time, and use your pour-over will certainly as a backstop to make sure that nothing stays beyond your trust fund.Sidebar: Revocable Depend On Vs An Unalterable Trust Fund

- She conscientiously moves all her investments and bank accounts that she can think about into her living trust.

- Conversely, they should be moved making use of some other technique, such as a proof of purchase, or an action in the case of real estate.

- Intestacy regulations might not lead to your favored circulation of properties.

- So it would certainly beat the function if an official probate proceeding were needed just to obtain possessions into your living trust.

- Her job has actually appeared on Forbes, CNN Underscored Cash, Investopedia, Credit Scores Karma, The Equilibrium, USA Today, and Yahoo Finance, among others.

- Some people purposely pick not to position all their properties into their depend on simultaneously.

Failsafe For Neglected Residential Property

Discover why you might require this estate planning tool and just how it works. An additional benefit of pour-over wills is that they give more personal privacy than making use of a traditional will. Assets that undergo probate are part of a court's documents and can be easily discovered by any member of the general public.Benefits Of Pour-over Wills

Therefore, the possessions may be dispersed in a manner the individual wouldn't have desired. A pour-over will certainly is an important file for anyone that has produced a living depend on as component of their estate plan. It's a specialized last will and testament, created to capture possessions that have not been retitled or transferred right into your living trust fund, "pouring" them right into the trust fund upon your fatality. If you have a last will and testament, the non-trust assets will be distributed according to the arrangements of that file. If you do not have a last will and testimony, your non-trust possessions will be distributed according to the legislations of intestate succession in your state. When utilized in tandem with a living depend on, a pour-over will certainly imitates a safety net to capture any kind of accounts and residential or commercial property that you forgot-- or did not have time-- to position in the trust fund. Matching it with a pour-over will can help wrangle any loose possessions that you deliberately (or unintentionally) really did not transfer to the living trust. A pour-over will is yet one more estate planning alternative that additionally ensures the defense of your properties. If you've developed a trust, or plan to start one, you might want to take into consideration adding a pour-over will. Some individuals intentionally pick not to position all their possessions into their trust simultaneously. Every one of these are most likely situations in which a pour-over will certainly include a layer of defense. A pour-over will certainly is a lawful file that ensures an individual's continuing to be properties will immediately transfer to a formerly established trust fund upon their fatality. You ought to talk to an experienced estate planning lawyer to make a decision whether a pour-over will certainly is the very best fit for your heritage. If you wish to establish a living trust fund, a pour-over will certainly can assist protect properties you do not move right into the depend on's name before you pass away. Also if you do not currently have a count on, you might have the ability to compose a pour-over will previously developing one.Iranian Estate Planning Lawyers & Pour Over Will - Tehran Times

Iranian Estate Planning Lawyers & Pour Over Will.

Posted: Sun, 17 Mar 2024 07:00:00 GMT [source]

That is behind the pour over?

Social Links