August 12, 2024

The Role Of Optional Count On Your Will

The Function Of Optional Rely On Your Will A monetary consultant can assist you arrange with the myriad of estate preparation alternatives. Eventually the objective is to minimise IHT on death yet, probably extra notably, pass assets to the next generation by means of a trust fund rather than outright. Every one of these trust funds will certainly achieve the last and the level of IHT performance depends on the option selected. The settlor can pass up or defer access to resources settlements if they want, so they can attain their purposes without having to make irrevocable decisions concerning their own future economic requirements. The gift into the Way of life Depend On is a Chargeable Lifetime Transfer for IHT objectives and if the settlor were to pass away within severn years of proclaiming the trust fund the the present remains component of the estate for IHT purposes. There is also an influence when gifts are made in this order, any stopped working PETs end up being chargeable and affect the estimation at the routine/ 10 annual fee.Gifting Residential Or Commercial Property To Children

- Take into consideration a scenario where the settlor proclaims an optional trust of say ₤ 1 million.

- The trustee( s) should follow a strict procedure when selecting to invest count on possessions.

- As the gift surpasses Helen's available NRB of ₤ 325,000, an unwanted of ₤ 75,000 develops and tax due on this totals up to ₤ 15,000.

- The trustee has a lot of discretion over just how the count on funds are made use of, and there is no need for a recipient to be notified of all the trust fund choices.

Comprehending Exactly How Discretionary Depends On Function

Phoenix Group to explore the sale of over 50s insurer, SunLife - IFA Magazine

Phoenix Group to explore the sale of over 50s insurer, SunLife.

Posted: Wed, 26 Jun 2024 09:24:30 GMT [source]

Extra Technical Assistance

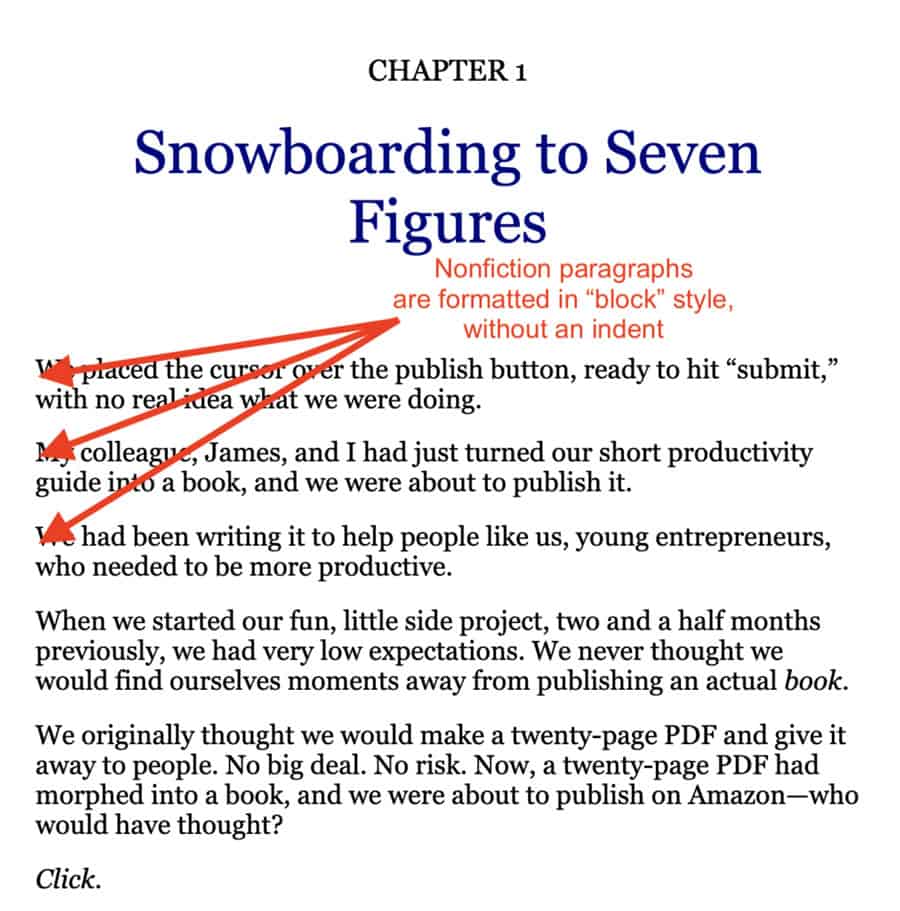

A common way to set up a discretionary trust is in a will yet you can additionally set one up during your life time With this sort of trust, cash and properties are put right into the count on for the benefit of the trust fund's beneficiaries. Beneficiaries can be named individuals or they can be teams of individuals, such as "my grandchildren." They can likewise consist of people that are not birthed yet. As a discretionary reduced present depend on, there are no called recipients, just a checklist of pre-determined people and various other lawful entities that might beome a recipient. Keep in mind that the rate computation State-specific Legal Requirements is based upon life time prices (half fatality price), also if the trust fund was set up under the will of the settlor. The rate of tax payable is then 30% of those rates appropriate to a 'Theoretical Chargeable Transfer'. When assessing the cost applicable when funds are distributed to a recipient, we need to take into consideration 2 circumstances. There is typically a certain reason for a person to be called an optional beneficiary. For example, they might be as well young or have actually displayed inadequate economic habits. Common terms connected to a discretionary recipient consist of that they reach age 18 or 21, graduate college, become drug-free, or find full employment before getting dispensations. With the optional trust settlor left out the settlor is not within the course of possible recipients, as a matter of fact the settlor is particularly omitted from taking advantage of the count on. As a result, the recipients' benefits will certainly be proportional to their "devices", contrasted to the shares in a company. A discretionary trust enables trustees to designate earnings and funding from the trust fund entirely at their discernment. They can choose that need to take advantage of the trust fund, when and in what proportion. This implies there's far more adaptability and funds can be paid out or held back as conditions alter. Continue reading to find whatever you require to know on establishing an optional trust fund action.What are the qualities of an optional trust?

- a couple of individuals who are the principal beneficiaries, the family members of the primary beneficiaries, firms possessed by the major beneficiaries and their family members; and.the distribution of funding and revenue to the beneficiaries goes to the discernment of the trustee. Discretionary trust funds are sometimes set up to place assets apart for: a future requirement, like a grandchild that might require much more financial aid than various other recipients eventually in their life. recipients that are not capable or responsible enough to take care of money themselves. 1. Just calling a solitary recipient.

Social Links