Pour-over Wills

Revocable Trust Fund Vs Irreversible Depend On: What's The Difference? You need to still place as numerous properties as possible in the trust and have the pour-over will certainly just in instance you left something out. A pour-over will is a particular lawful tool that is only beneficial as component of an extensive estate strategy. An experienced Austin estate planning attorney from Massingill can work closely with you to establish a reliable plan for you. The main advantage of using a. pour-over will certainly is how basic the estate planning process can be. As opposed to determining who gets what within the will, you can have all your assets transferred to your depend on and managed on behalf of your successors.Revocable Trust Fund Vs Unalterable Trust Fund: What's The Distinction?

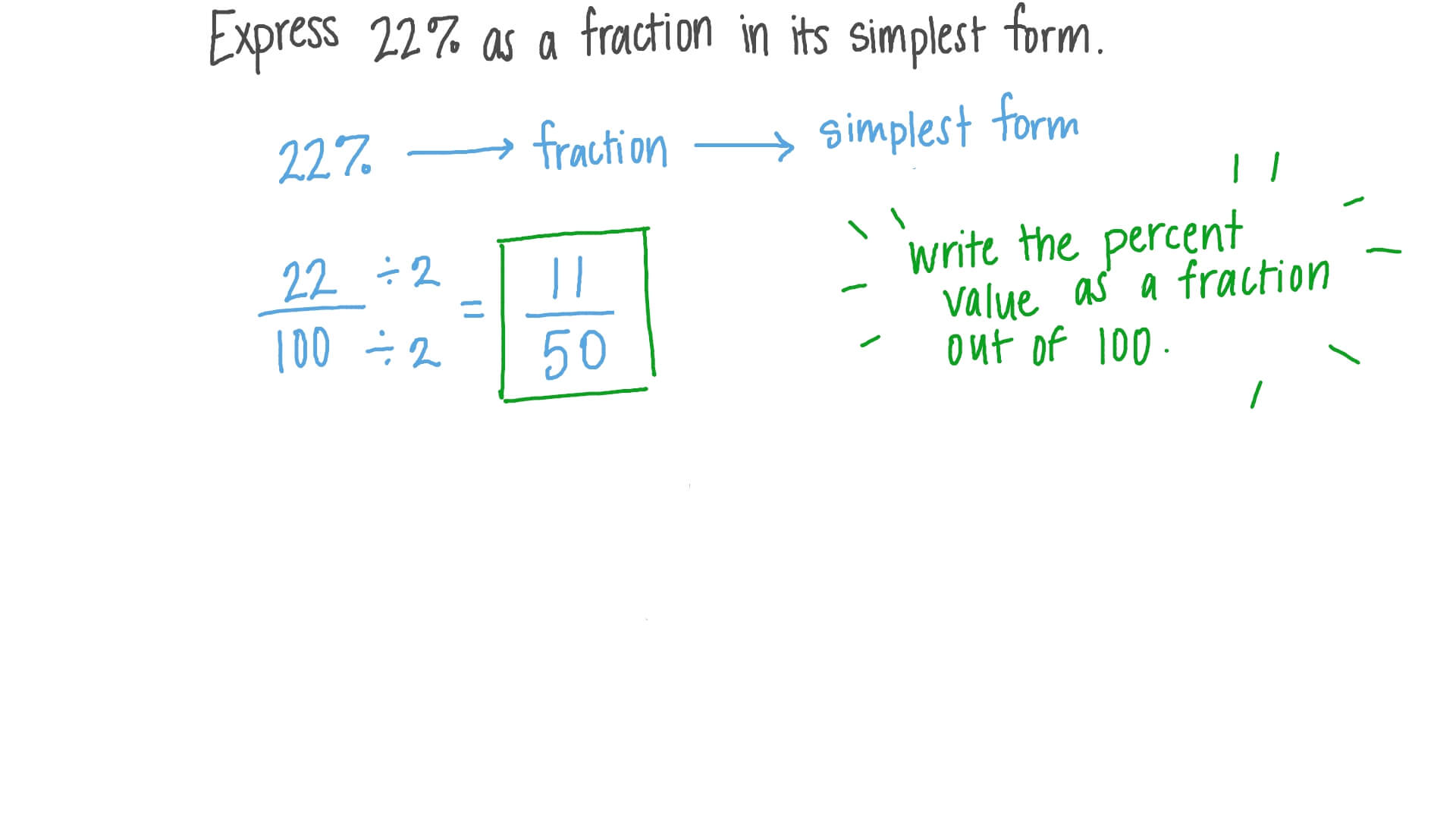

Unless your estate gets probate shortcut, properties that travel through the pour-over will still need to undergo probate. The specifics of which heirs get money and property under intestacy laws will certainly depend upon which living connections you have. As an example, if you are wed and have kids from outside that marriage, typically a portion of the possessions in your estate will certainly pass to your spouse and a portion to your youngsters. The primary advantage of an irreversible count on is that the properties are gotten rid of from your taxed estate. Yet this may not be very important to you if the estate is totally secured from tax obligation by the federal gift and inheritance tax exception.European consumers prioritise packaging in coffee-purchase decisions - Tea & Coffee Trade Journal

European consumers prioritise packaging in coffee-purchase decisions.

Posted: Thu, 06 Jun 2024 07:00:00 GMT [source]

Regarding Living Counts On

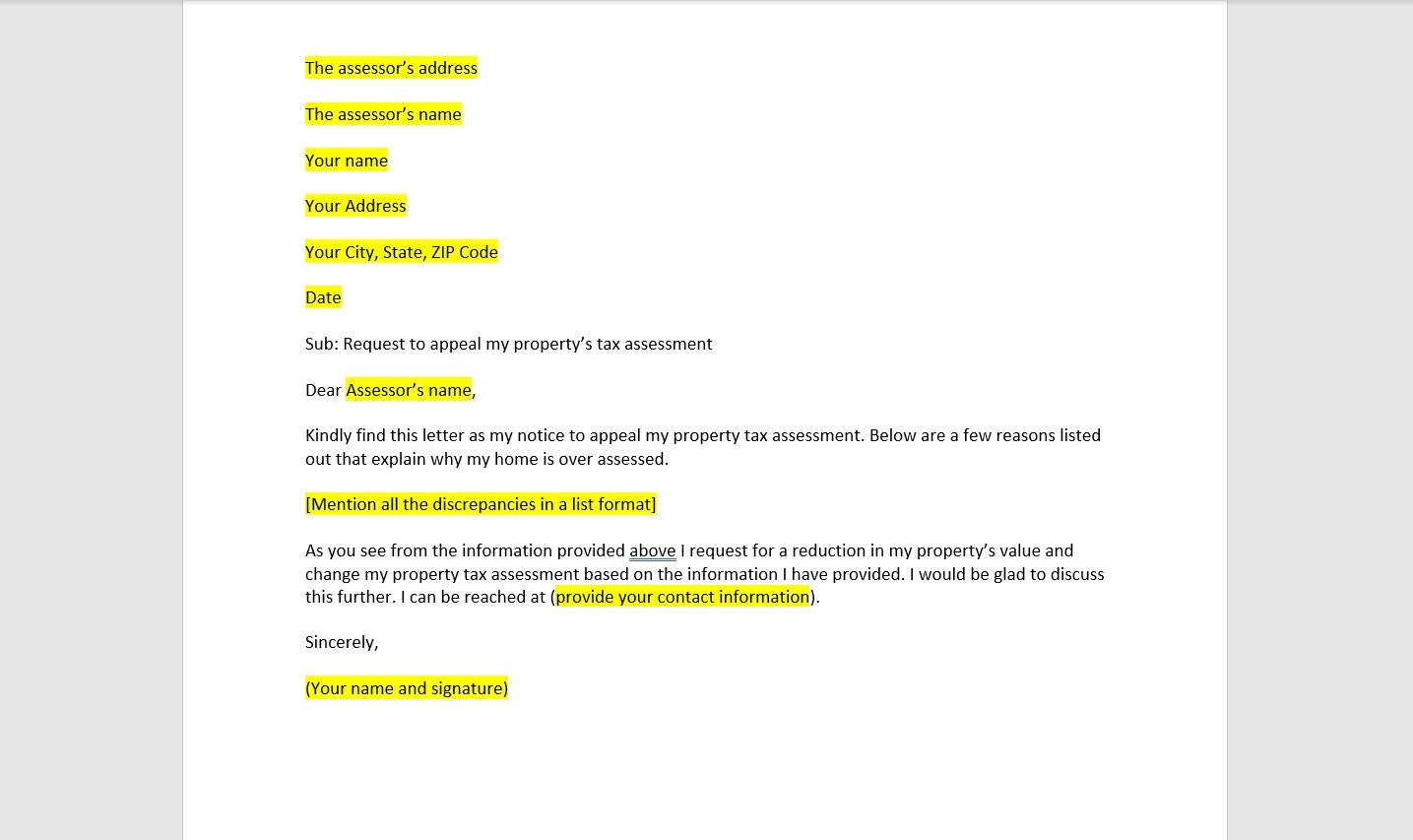

That way, your will is currently on data and with the the clerk if it's later uncovered that you have assets requiring probate. When you produce a Will through a trusted company like Trust fund & Will, you'll instantly obtain a Pour Over Will as component of our detailed Estate Planning process. This way, you're already established to benefit from the advantages of having a Depend on, and you'll have a Will in position that sees to it absolutely nothing is failed to remember.- This overview highlights the advantages of a living will certainly and why you must encourage enjoyed ones to produce one.

- Need to you go this course, you may think about setting up a related document called a pour-over will certainly too.

- And, if you're complete with the transfer of assets made directly to the living trust fund, the deposit ought to be relatively small, and maybe there won't be anything that will pass using the will.

- With a pour-over will, the testator requirement only include certain useful building in the count on, and all various other residential property is covered by the will.

What is the best trust to avoid inheritance tax?

. This is an irreversible trust right into which you place assets, once more securing them from inheritance tax. https://ewr1.vultrobjects.com/family-will-services/custom-will-creation/will-lawyers/what-are-the-various-kinds-of-wills-and-what-should-they.html A Living Will just comes to be reliable if you are established to have a terminal ailment or are at the end-of-life and when you are no more able to connect your wishes. In New York City State, the Living Will certainly was licensed by the courts (not by legislation )so there are no demands assisting its use. As quickly as this occurs, your will is legitimately valid and will be approved by a court after you pass away. Wills don't end. These files simply specify your choices concerning what you intend to occur to your home and various other passions after you pass away. An irrevocable trust fund provides you with even more protection. While you can't modify it, financial institutions can not conveniently make claims versus it, and assets held within it can usually be passed on to recipients without being subject to inheritance tax. You do not stay clear of probate with pour-over wills as they still go through probate, and the count on can not be liquified during the probate procedure. While the properties that put over